So You Think Lower EMI Is Freedom? Let’s Talk About Real Loan Resolution

“Bhai, bas EMI kam ho jaye... saans toh le paunga.”

That’s what someone told me last week.

And I get it. You’re not alone.

The calls from recovery agents don’t stop. Your credit card loan issues don’t wait. Your bank doesn’t care if you lost your job.

So when a bank says, “Let’s consolidate your loan,” it sounds like relief.

But you know what I’ve seen again and again?

It’s not a rescue — it’s a rerun.

Let’s sit down. Not like some brochure pretending everything’s fine — but like two people honestly figuring out how to become debt-free legally.

The Illusion of Lower EMI

Quick story:

You owe ₹10 lakhs. The bank says,

“Pay ₹34,000/month for 3 years.”

You say, “Too much.”

They say,

“Okay. Make it 6 years. Just ₹19,500/month.”

You say, “Done. Shukriya.”

You sleep better that night.

Fast forward 6 years:

You’ve paid ₹14+ lakhs instead of ₹12.3 lakhs.

That “peace of mind” cost you ₹1.8 lakhs in interest.

That’s just one loan.

Now imagine your credit card, personal loan, and car loan all bundled into one — you’re not repaying anymore. You’re just financing your debt.

What’s the Real Difference?

| Debt Consolidation | Loan Resolution (Cut My Loan) |

|---|---|

| Lower EMI, longer time | Reduce total amount owed |

| Bank earns more | You save more |

| Debt stays longer | Debt ends sooner |

| Harassment continues | Recovery agents harassment stops legally |

| You feel like you’re winning | You actually win |

What Cut My Loan Actually Does (And Why It Works)

This is not some shady agent claiming to “talk to the bank.”

It’s structured, RBI-guided, legal work.

1. Eligibility Check – Should You Even Pay That Much?

Facing cheque bounce, missed EMIs, credit card loan issues?

Cut My Loan checks your case and tells you if settlement is a better option than repayment.

Sometimes, you don’t need to pay more — you need to pay smart.

2. They Negotiate With Banks – You Don’t Beg

No more calling your branch manager 10 times.

They negotiate on your behalf — reducing dues by 50–70%, depending on your situation.

It’s all documented. No verbal promises — just paperwork.

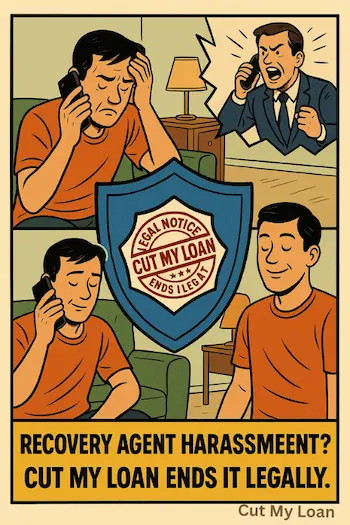

3. Recovery Agent Harassment? Finished.

No more illegal calls, threats, or visits.

They send legal anti-harassment notices and file official complaints if required.

Most agents stop the moment they know it’s a legal case.

4. You Become Loan-Free — With Proof

The best part?

You don’t just feel free — you are free:

- Settlement Letter

- No Dues Certificate

- CIBIL Score rebuilding help

This is not relief — this is real closure.

India’s Cities Are Drowning in Quiet Debt

Delhi. Mumbai. Patna. Jaipur. Ranchi. Lucknow.

Same story:

- People thought EMI adjustment was the only way

- They never heard of loan resolution

- Nobody told them Cut My Loan exists

Too many are paying interest for peace, when they could be paying off for freedom.

Final Thought — From One Tired Mind to Another

If you’ve read this far, chances are:

- You’ve ignored unknown numbers

- You’ve been up at night

- You’ve opened your banking app in fear

So let me say this loud and clear:

You don’t need a lower EMI.

You need an exit.

Don’t drag your pain across 6 years.

Don’t normalize stress.

Cut the loan. Close the chapter. Move on.

What Cut My Loan Offers

- Loan resolution (not just EMI stretching)

- Recovery agents harassment protection

- Legal advice for cheque bounce cases

- Pan-India support – big cities and small towns

- Proper documentation – No Dues, Settlement Letter, CIBIL rebuild

Ready to End This Chapter?

Visit CutMyLoan.com or give them a call.

Because your loan shouldn’t own your life.

Also follow us on Instagram for real stories, updates, and tips.

Frequently Asked Questions

Is loan consolidation and loan resolution the same?

No. Consolidation combines loans for lower EMI but extends tenure and interest. Resolution aims to reduce total debt and close the loan faster.

Can Cut My Loan help with recovery agent harassment?

Yes. They issue legal notices and complaints, stopping illegal threats and calls.

Will resolving my loan hurt my CIBIL score?

Initially it might drop, but Cut My Loan provides support to rebuild your CIBIL score post-resolution.

Can I settle credit card dues legally?

Yes. Through RBI-compliant loan settlement processes, Cut My Loan helps legally reduce and close card dues.

What documents will I get after resolution?

You receive a Settlement Letter, No Dues Certificate, and CIBIL support documentation.

Is this service available outside metro cities?

Yes. Cut My Loan supports clients across India, including Tier 2 and Tier 3 cities.

How much can I expect to save through resolution?

Depending on your case, dues can be reduced by 50–70% legally.

Do I need to speak with the bank directly?

No. Cut My Loan handles bank negotiations on your behalf with proper legal documentation.