How to Stop Recovery Agents Harassment Legally in India

Your witty-yet-wise guide to taking back control without throwing your phone into a well.

Let’s Set The Scene

You took a loan. You had a plan. But life—being the unpredictable little rascal it is—had other ideas. Maybe it was a medical emergency. Maybe a job loss. Or maybe you just watched too many finance influencers yelling “Buy that iPhone 15 on EMIs, bro! Assets over liabilities, who?”

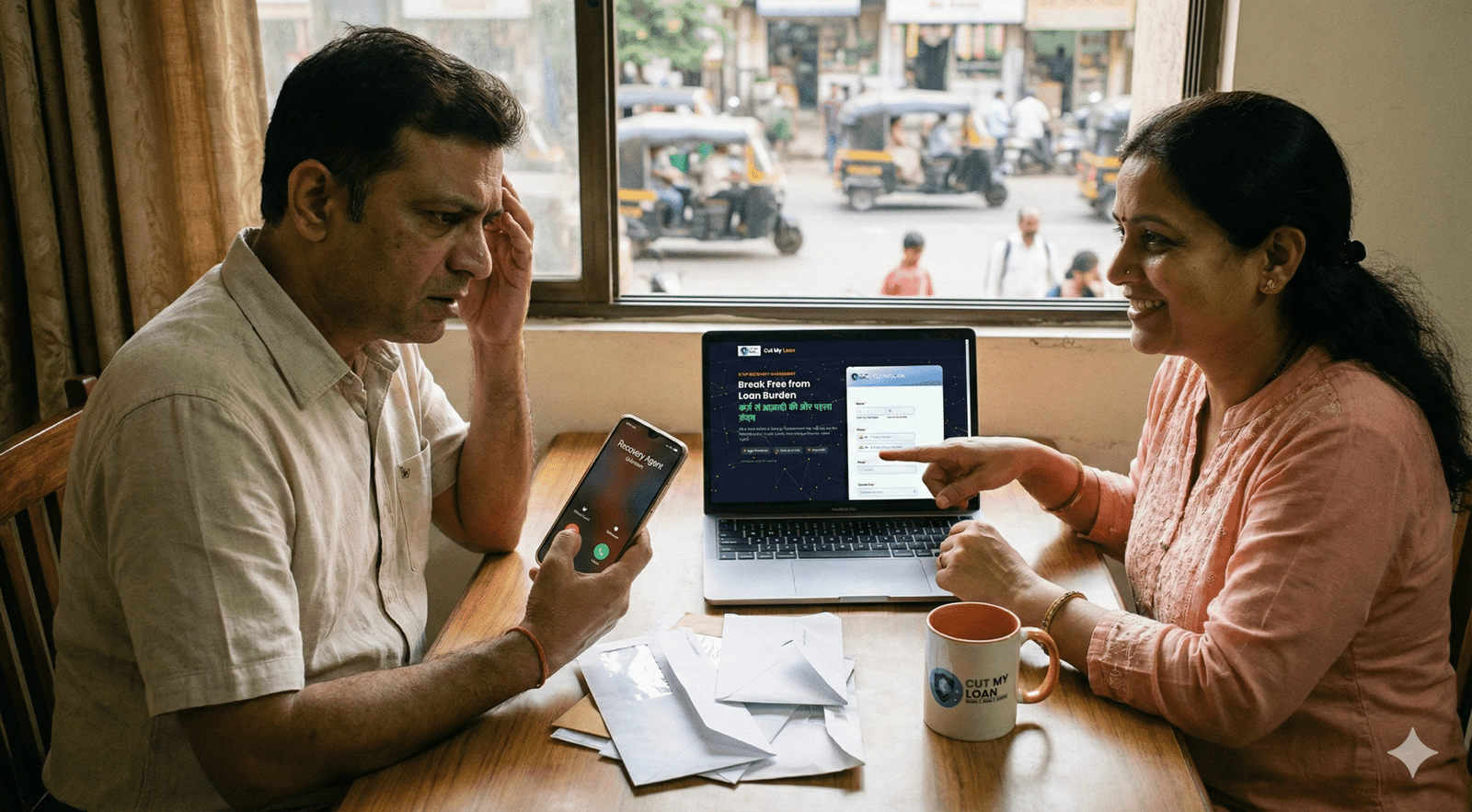

Whatever your reason, the EMI didn’t go through. Once. Then twice. Now it’s raining calls from strange men who sound like they're starring in an under-budgeted crime thriller: “Sir, if you don’t pay, I will come to your office. Your neighbors will also know.”

Classic recovery agent threat vibes. But guess what? That’s illegal. And you don’t have to take it lying down.

1. First, Let’s Be Real: You’re Not Alone

Welcome to the unofficial club of "Debt Happens"—population: millions of Indians. From loan defaults to credit card issues and cheque bouncing nightmares, the struggle is very, very real.

Banks know it. NBFCs know it. And yes, CutMyLoan definitely knows it. That’s why we built a platform to resolve loan issues, protect people from recovery agent harassment, and help you breathe without flinching at every “Unknown Number” call.

2. What Exactly Is Recovery Agent Harassment?

It’s when recovery agents go from “gentle reminders” to “emotional blackmail, threats, public shaming, or even showing up at your door like it’s a Netflix docuseries.”

Some classic symptoms include:

- Calling 30 times a day (because 29 wasn’t enough).

- Threatening to inform your boss, mother-in-law, or gym trainer.

- Showing up uninvited like your clingy ex.

- Abusing, yelling, or recording your conversations.

Spoiler: None of this is legal. Even if you owe money.

3. Know Your Legal Rights (So You Can Flex Them)

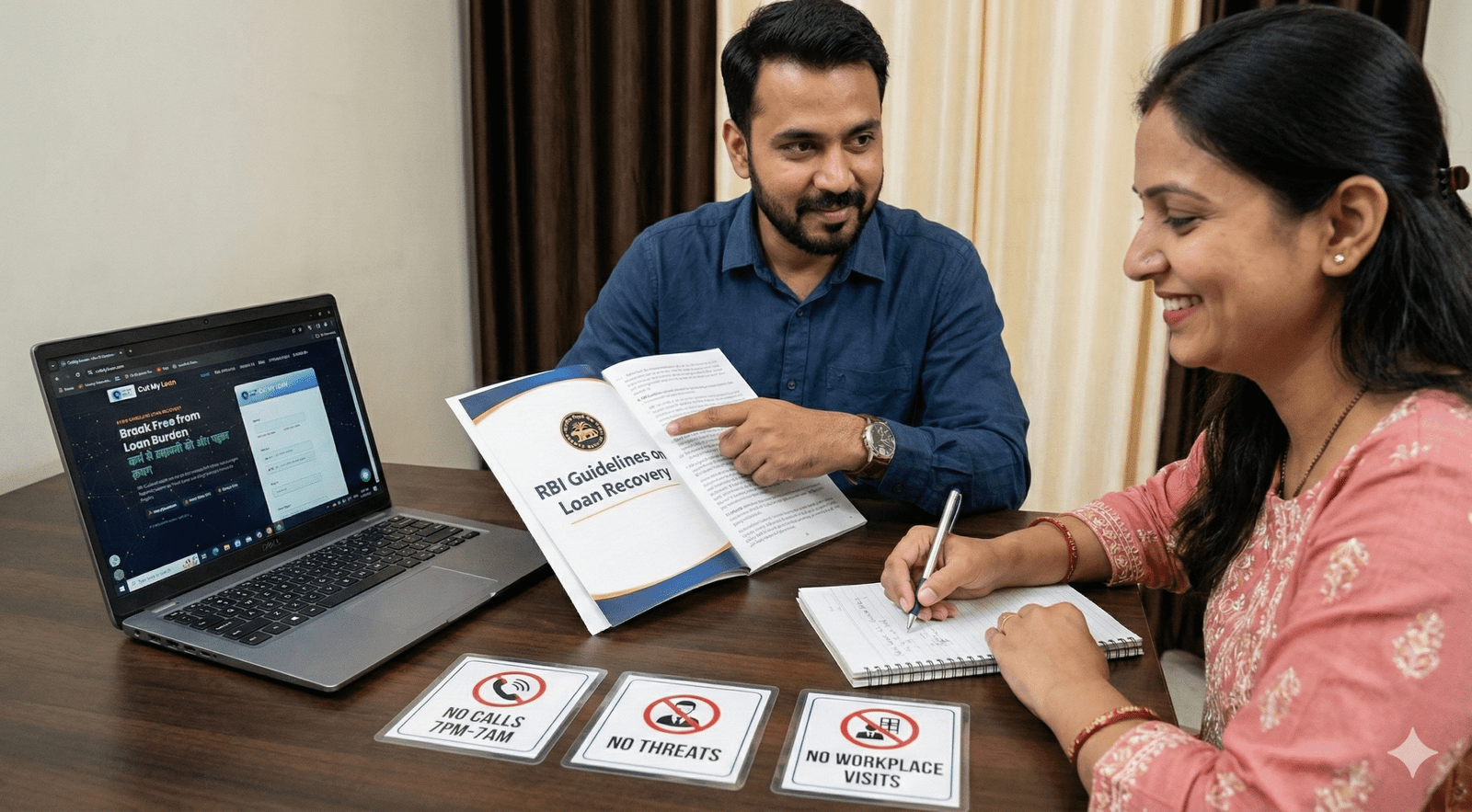

You have rights under RBI guidelines on Fair Practices Code, the Indian Contract Act, and various court precedents. Here's what recovery agents cannot legally do:

- Harass you at odd hours: They can’t call or visit you before 7 AM or after 7 PM. This isn't KBC Prime Time.

- Threaten or intimidate you: No gundagardi allowed. If they’re crossing the line, you can file a police complaint.

- Show up at your workplace: Newsflash: they're not your new HR. This is unethical and a privacy breach.

- Call your friends or family: Your EMI isn’t their business. Recovery agents calling your mom to “teach you manners” is 100% a red flag.

4. So What Can You Do?

You could meditate. Or scream into a pillow. OR you could take these actual, practical steps:

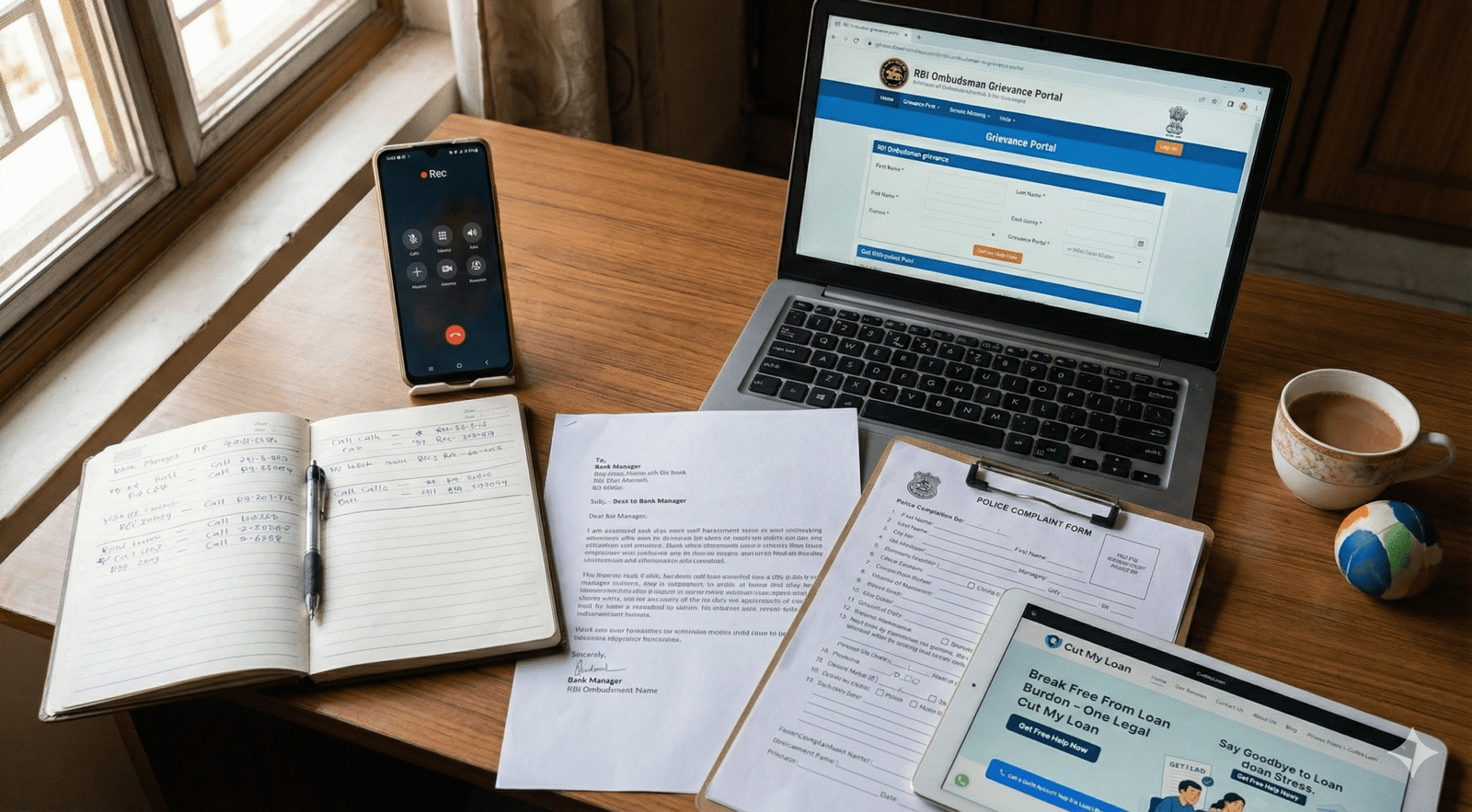

Record Everything

Call logs, voice notes, WhatsApp chats—document all the nonsense. This is your evidence stack if you decide to take legal action.

Lodge a Complaint with the Lender

Go to your bank/NBFC. Tell them what’s happening. Legally, they are responsible for their agents.

File a Police Complaint

You can file a complaint under IPC Sections 503 (criminal intimidation) or 504 (intentional insult) if things get ugly.

Complain to RBI

RBI has set up a grievance redressal system. You can write to the Banking Ombudsman. Agents hate RBI-level drama.

Let CutMyLoan Handle It

Why do all the work? We specialize in anti-harassment interventions and negotiating peacefully with banks. We help you structure a peaceful exit plan—without the gundas and guilt-tripping.

5. Bonus: What If You Actually Want to Pay? (But Can’t Yet)

Not all heroes wear capes. Some wear guilt and are trying to make it right. If you're trying to resolve your loan payment issues, CutMyLoan helps with One-time settlement negotiations, EMI restructuring, and reduced interest plans.

6. Stop Feeling Ashamed (Start Feeling Empowered)

Taking a loan isn’t a crime. Struggling to repay it isn’t a character flaw. But harassing someone over it? That is a crime.

Whether you live in Delhi, Mumbai, or Timbuktu, harassment is unacceptable. With CutMyLoan, thousands of Indians are getting their dignity back and turning their “debt horror stories” into “financial glow-ups”. So why not you?

7. Here’s What You Can Do Right Now

- Visit www.cutmyloan.com

- Fill out your issue—loan default, credit card overdue, whatever.

- Our experts will check your eligibility and get in touch.

- Sit back. We’ll deal with the drama. You deal with...peace.

Final Word: Your EMI Doesn’t Come With Emotional Damage

Don’t let loan recovery agents write your misery script. You’re a human with a hiccup—and you deserve solutions, not suffering.

And remember: when life gives you EMIs, don’t panic. Just let the pros negotiate them for you—with a smile.

Frequently Asked Questions

Yes, it is absolutely illegal. According to RBI guidelines and privacy laws, recovery agents cannot discuss your debt with third parties, including family members, friends, or neighbors. Their only point of contact should be the borrower or guarantor.

No. For unsecured loans (like personal loans or credit cards), agents have zero right to seize property. For secured loans (like home or car loans), banks must follow due legal process under the SARFAESI Act, which involves issuing notices before any repossession. Musclemen cannot just walk in and take your assets.

The RBI has mandated that recovery agents can only contact borrowers between 7:00 AM and 7:00 PM. Calling outside these hours is a violation of regulatory guidelines and constitutes harassment.

Agents should generally avoid visiting your workplace unless you have stopped responding to calls at home or have specifically agreed to meet them there. Showing up unannounced to create a scene or embarrassment at your office is a violation of your privacy and RBI's fair practices code.

Start recording the call immediately. Inform them that the call is being recorded. Do not engage in abuse back. Disconnect the call and save the recording as evidence. You should then lodge a complaint with the lender and potentially the police.

Yes. If the agent threatens you, uses abusive language, intimidates you, or trespasses on your property, you can file an FIR under relevant sections of the Indian Penal Code (IPC), such as Section 503 (criminal intimidation) or Section 504 (intentional insult).

CutMyLoan primarily focuses on pre-litigation resolution. We use legal expertise to negotiate with banks and stop harassment before it reaches court. If a matter is already in court, our team can review your case and guide you on the best negotiation strategy, but we do not represent you inside the courtroom.

Merely consulting us does not affect your score. However, if your loan is already in default, your score is likely already impacted. Our goal is to negotiate a settlement or restructuring that stops further damage and helps you eventually rebuild your score, rather than letting it spiral due to indefinite non-payment.

The Banking Ombudsman is a senior official appointed by the RBI to redress customer complaints against banks for deficiency in certain services, including harassment by recovery agents. If your bank does not resolve your complaint within 30 days, you can escalate it to the Ombudsman.

Once you register and our legal team intervenes by sending formal communication to your lender regarding representation, the intensity of harassment usually drops significantly within 24-48 hours. We formally instruct them to direct all future communication through us.